JP Morgan is the Superhero of the Banking Crisis

JP Morgan the Superhero of the Banking Crisis

JP Morgan Chase is buying First Republic Bank’s deposits, along with a “substantial amount of their assets and certain liabilities,” after the failing bank was placed in the FDIC’s receivership overnight. The Feds seize First Republic Bank, then sell it to JP Morgan Chase.

After seizing control of the troubled First Republic, the FDIC announced the transaction right away. The FDIC will lose $13 billion as a result of the disaster. The nation’s banks, which contribute to the agency by paying premiums, will pay that sum.

Following the weekend seizure of the troubled lender by regulators, JPMorgan Chase & Co (JPM.N) announced on Monday that it would purchase the majority of First Republic Bank’s (FRC.N) assets. This marks the third failure of a significant U.S. bank in the past two months.

However, the collapse of First Republic shows that the banking crisis is still ongoing. Following a period in which no banks failed in either 2021 or 2022, First Republic represents the third bank failure in the previous seven weeks.

Details of the deal

While First Republic Bank’s corporate debt and preferred stock will not be accepted, JP Morgan, already the largest bank in the US, has entered into a loss-share agreement with the FDIC on single-family, residential, and commercial loans it purchased.

The agreement enables First Republic to fail in a controlled manner and spares authorities from having to guarantee all of the bank’s deposits, as they were forced to do when two other banks failed in March.

Last week, First Republic revealed that it had experienced more than $100 billion in outflows in the first quarter and was considering its alternatives, adding to the stress in the banking industry.

The failure of Silicon Valley Bank and Signature Bank in March shocked the banking industry, and rival UBS had to step in and save Switzerland’s Credit Suisse (CSGN.S).

Prior to being suspended on Monday, premarket trading in First Republic shares fell 43.3%. This year, the value of the bank’s stock has dropped by 97%. Shares of JP Morgan climbed 2.7%.

Is the Fed rate the cause of this crisis?

Since last year, the U.S. Federal Reserve has steadily increased its benchmark interest rate, defying demands for a pause in the wake of the March banking crisis.

After the central bank’s two-day policy meeting on Wednesday, investors have priced in a 90% chance of another 25 basis point rate hike, according to CME Group’s FedWatch tool.

Sources say JPMorgan was one of a number of prospective purchasers, along with PNC Financial Services Group (PNC.N) and Citizens Financial Group Inc. (CFG.N), that submitted final bids on Sunday in an auction held by American regulators.

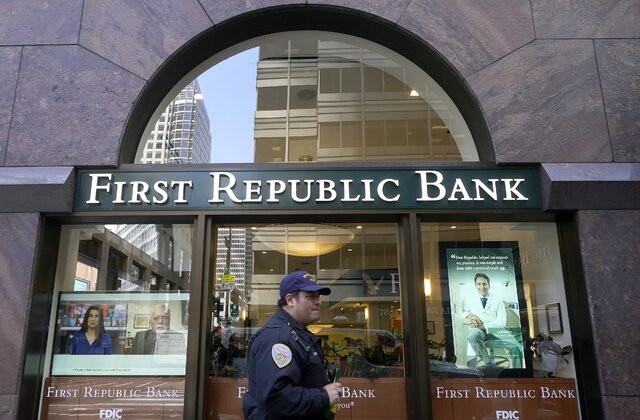

A security officer walks outside of a First Republic Bank location in San Francisco, Wednesday, April 26, 2023.(JEFF CHIU/AP)

The bank takeover process

First Republic has been taken over, according to the California Department of Financial Protection and Innovation, and the FDIC will serve as its receiver.

The cost to the Deposit Insurance Fund (DIF) was projected by the FDIC to be at $13 billion. The FDIC’s termination of the receivership will reveal the final price.

According to the statement, JPMorgan has taken over all of the bank’s deposits and will refund $25 billion of the $30 billion in deposits made by large banks with First Republic in March. JPMorgan, with headquarters in New York, will take on $173 billion in loans, $30 billion in securities, and $92 billion in deposits.

“Our government invited us and others to step up, and we did,” said Jamie Dimon, JPMorgan Chairman and CEO.

According to JPMorgan, it expects to make a one-time, post-tax gain of around $2.6 billion as a result of the transaction, which does not include an anticipated $2 billion in post-tax restructuring charges that are projected to occur over the next 18 months.

The 84 locations across eight states of the defunct bank will reopen as JPMorgan Chase Bank branches starting on Monday, it was noted.

Since 2021, JPMorgan has acquired more than 30 businesses in transactions worth more than $5 billion.

In recent years, American authorities have been reluctant to sanction significant bank mergers, even though the Biden administration has been tough on anti-competitive behavior.

The Fed increased its target rate by more than 400 basis points in 2022, and most of this was due to an increase in the natural interest rate, which in turn was due to a previous easy money policy’s acceleration of nominal gross domestic product (NGDP) growth.

Von Keller Blog is an informational website with public news, company insights and reports of our companies events, news, press and blogging. Let’s Chat.

- Global Pet Adoption by North Shore Animal League - May 1, 2023

- JP Morgan is the Superhero of the Banking Crisis - May 1, 2023

- Data from satellites Deforestation in Brazil’s Amazon has decreased since last year. - March 16, 2023